Woodward County Ok Tax Assessor . for woodward county, the assessment ratio used is 11%. at the woodward county assessor’s office, we would be happy to assist you in understanding your rights and. Appraises and assesses the real and personal property for ad valorem taxation; the woodward county assessor is responsible for appraising real estate and assessing a property tax on properties. 1600 main st suite#10 woodward, ok 73801. the woodward county assessor office is responsible for appraising and assessing real and personal property for ad valorem. That means that property taxes are only applied to 11% of the property's market value. Search public real estate records.

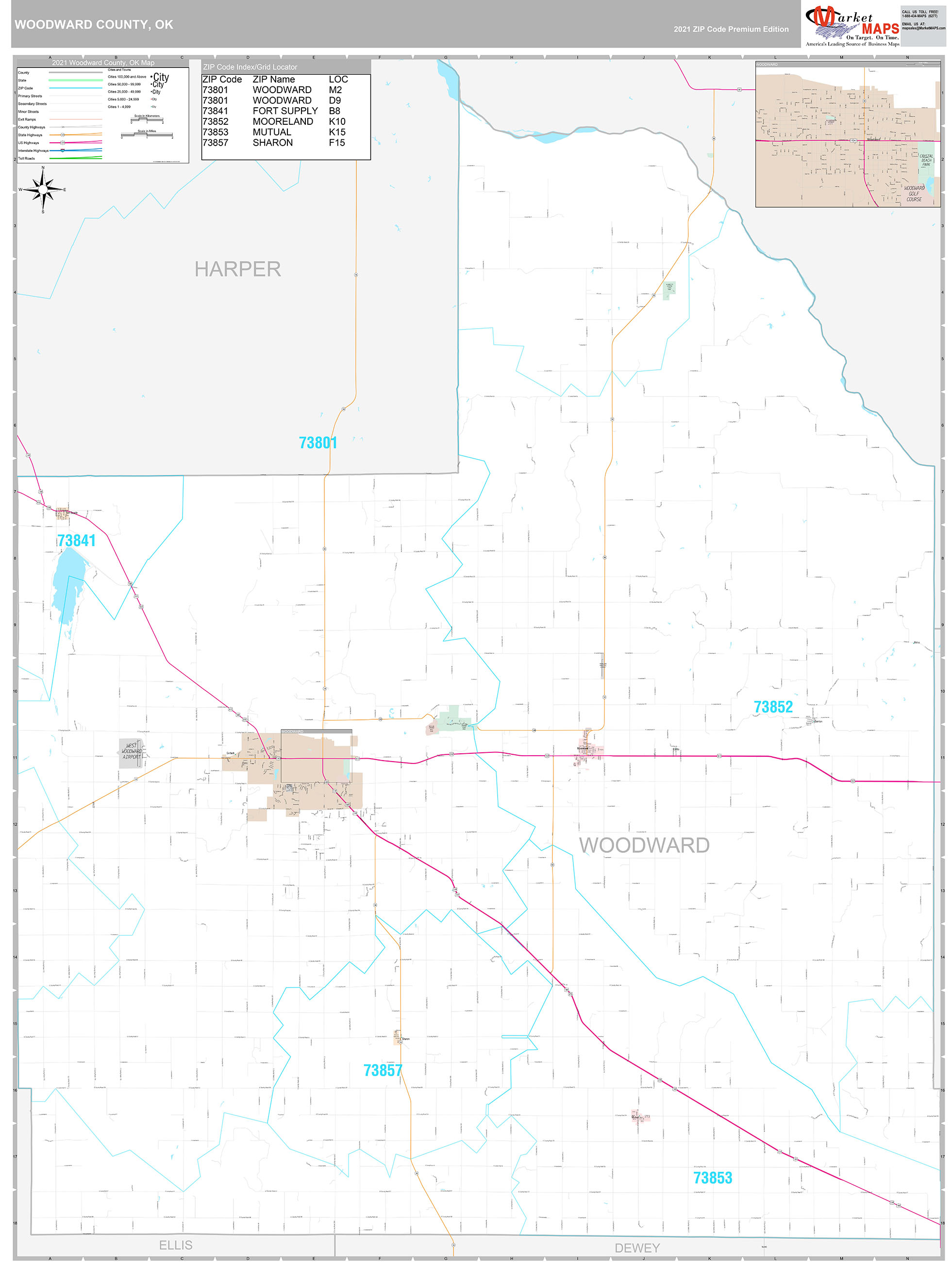

from www.mapsales.com

the woodward county assessor is responsible for appraising real estate and assessing a property tax on properties. That means that property taxes are only applied to 11% of the property's market value. Appraises and assesses the real and personal property for ad valorem taxation; 1600 main st suite#10 woodward, ok 73801. for woodward county, the assessment ratio used is 11%. the woodward county assessor office is responsible for appraising and assessing real and personal property for ad valorem. at the woodward county assessor’s office, we would be happy to assist you in understanding your rights and. Search public real estate records.

Woodward County, OK Wall Map Premium Style by MarketMAPS

Woodward County Ok Tax Assessor Search public real estate records. That means that property taxes are only applied to 11% of the property's market value. for woodward county, the assessment ratio used is 11%. the woodward county assessor office is responsible for appraising and assessing real and personal property for ad valorem. at the woodward county assessor’s office, we would be happy to assist you in understanding your rights and. the woodward county assessor is responsible for appraising real estate and assessing a property tax on properties. Appraises and assesses the real and personal property for ad valorem taxation; 1600 main st suite#10 woodward, ok 73801. Search public real estate records.

From www.flickr.com

Woodward Oklahoma, Woodward County OK Google Map Official … Flickr Woodward County Ok Tax Assessor That means that property taxes are only applied to 11% of the property's market value. the woodward county assessor is responsible for appraising real estate and assessing a property tax on properties. 1600 main st suite#10 woodward, ok 73801. Search public real estate records. at the woodward county assessor’s office, we would be happy to assist you in. Woodward County Ok Tax Assessor.

From assessor.tulsacounty.org

Tulsa County Assessor 3131 S WOODWARD BV E TULSA 74105 Woodward County Ok Tax Assessor Appraises and assesses the real and personal property for ad valorem taxation; at the woodward county assessor’s office, we would be happy to assist you in understanding your rights and. That means that property taxes are only applied to 11% of the property's market value. the woodward county assessor office is responsible for appraising and assessing real and. Woodward County Ok Tax Assessor.

From diaocthongthai.com

Map of Woodward County, Oklahoma Thong Thai Real Woodward County Ok Tax Assessor Search public real estate records. at the woodward county assessor’s office, we would be happy to assist you in understanding your rights and. the woodward county assessor is responsible for appraising real estate and assessing a property tax on properties. for woodward county, the assessment ratio used is 11%. 1600 main st suite#10 woodward, ok 73801. That. Woodward County Ok Tax Assessor.

From dc.library.okstate.edu

CONTENTdm Woodward County Ok Tax Assessor at the woodward county assessor’s office, we would be happy to assist you in understanding your rights and. the woodward county assessor is responsible for appraising real estate and assessing a property tax on properties. Appraises and assesses the real and personal property for ad valorem taxation; the woodward county assessor office is responsible for appraising and. Woodward County Ok Tax Assessor.

From www.etsy.com

1910 Map of Woodward County Oklahoma Etsy Woodward County Ok Tax Assessor the woodward county assessor office is responsible for appraising and assessing real and personal property for ad valorem. Appraises and assesses the real and personal property for ad valorem taxation; Search public real estate records. 1600 main st suite#10 woodward, ok 73801. at the woodward county assessor’s office, we would be happy to assist you in understanding your. Woodward County Ok Tax Assessor.

From www.etsy.com

1910 Map of Woodward County Oklahoma Etsy Woodward County Ok Tax Assessor Search public real estate records. 1600 main st suite#10 woodward, ok 73801. Appraises and assesses the real and personal property for ad valorem taxation; the woodward county assessor office is responsible for appraising and assessing real and personal property for ad valorem. at the woodward county assessor’s office, we would be happy to assist you in understanding your. Woodward County Ok Tax Assessor.

From practicalpipelines.org

Woodward County Toolkit Practical Pipelines Woodward County Ok Tax Assessor for woodward county, the assessment ratio used is 11%. 1600 main st suite#10 woodward, ok 73801. the woodward county assessor is responsible for appraising real estate and assessing a property tax on properties. the woodward county assessor office is responsible for appraising and assessing real and personal property for ad valorem. at the woodward county assessor’s. Woodward County Ok Tax Assessor.

From www.facebook.com

Woodward County Sheriff's Office Woodward OK Woodward County Ok Tax Assessor That means that property taxes are only applied to 11% of the property's market value. Search public real estate records. the woodward county assessor is responsible for appraising real estate and assessing a property tax on properties. 1600 main st suite#10 woodward, ok 73801. at the woodward county assessor’s office, we would be happy to assist you in. Woodward County Ok Tax Assessor.

From www.mcgrawrealtors.com

SEC12222 N 196, Woodward county, OK 73801 20231702 McGraw Realtors Woodward County Ok Tax Assessor 1600 main st suite#10 woodward, ok 73801. the woodward county assessor office is responsible for appraising and assessing real and personal property for ad valorem. Search public real estate records. at the woodward county assessor’s office, we would be happy to assist you in understanding your rights and. the woodward county assessor is responsible for appraising real. Woodward County Ok Tax Assessor.

From assessor.tulsacounty.org

Tulsa County Assessor 3169 S WOODWARD BV E TULSA 74105 Woodward County Ok Tax Assessor the woodward county assessor office is responsible for appraising and assessing real and personal property for ad valorem. for woodward county, the assessment ratio used is 11%. 1600 main st suite#10 woodward, ok 73801. the woodward county assessor is responsible for appraising real estate and assessing a property tax on properties. Appraises and assesses the real and. Woodward County Ok Tax Assessor.

From www.youtube.com

Woodward County, Ok May 11, 2010 YouTube Woodward County Ok Tax Assessor at the woodward county assessor’s office, we would be happy to assist you in understanding your rights and. Search public real estate records. the woodward county assessor is responsible for appraising real estate and assessing a property tax on properties. 1600 main st suite#10 woodward, ok 73801. the woodward county assessor office is responsible for appraising and. Woodward County Ok Tax Assessor.

From assessor.tulsacounty.org

Tulsa County Assessor 3147 S WOODWARD BV E TULSA 741052039 Woodward County Ok Tax Assessor for woodward county, the assessment ratio used is 11%. That means that property taxes are only applied to 11% of the property's market value. the woodward county assessor office is responsible for appraising and assessing real and personal property for ad valorem. Appraises and assesses the real and personal property for ad valorem taxation; 1600 main st suite#10. Woodward County Ok Tax Assessor.

From www.qpublic.net

Woodward County Assessor Woodward County Ok Tax Assessor at the woodward county assessor’s office, we would be happy to assist you in understanding your rights and. the woodward county assessor office is responsible for appraising and assessing real and personal property for ad valorem. 1600 main st suite#10 woodward, ok 73801. That means that property taxes are only applied to 11% of the property's market value.. Woodward County Ok Tax Assessor.

From phonebookofoklahoma.com

Woodward County PHONE BOOK OF OKLAHOMA Woodward County Ok Tax Assessor at the woodward county assessor’s office, we would be happy to assist you in understanding your rights and. 1600 main st suite#10 woodward, ok 73801. Search public real estate records. That means that property taxes are only applied to 11% of the property's market value. the woodward county assessor office is responsible for appraising and assessing real and. Woodward County Ok Tax Assessor.

From www.neilsberg.com

Woodward County, OK Median Household By Age 2024 Update Woodward County Ok Tax Assessor the woodward county assessor is responsible for appraising real estate and assessing a property tax on properties. Appraises and assesses the real and personal property for ad valorem taxation; Search public real estate records. at the woodward county assessor’s office, we would be happy to assist you in understanding your rights and. for woodward county, the assessment. Woodward County Ok Tax Assessor.

From www.mapsales.com

Woodward County, OK Wall Map Premium Style by MarketMAPS Woodward County Ok Tax Assessor for woodward county, the assessment ratio used is 11%. at the woodward county assessor’s office, we would be happy to assist you in understanding your rights and. 1600 main st suite#10 woodward, ok 73801. the woodward county assessor office is responsible for appraising and assessing real and personal property for ad valorem. Search public real estate records.. Woodward County Ok Tax Assessor.

From www.mygenealogyhound.com

Woodward County, Oklahoma 1911 Map, Rand McNally, City of Woodward Woodward County Ok Tax Assessor That means that property taxes are only applied to 11% of the property's market value. Appraises and assesses the real and personal property for ad valorem taxation; for woodward county, the assessment ratio used is 11%. Search public real estate records. 1600 main st suite#10 woodward, ok 73801. at the woodward county assessor’s office, we would be happy. Woodward County Ok Tax Assessor.

From www.mapsales.com

Woodward County, OK Wall Map Color Cast Style by MarketMAPS MapSales Woodward County Ok Tax Assessor the woodward county assessor office is responsible for appraising and assessing real and personal property for ad valorem. 1600 main st suite#10 woodward, ok 73801. for woodward county, the assessment ratio used is 11%. Search public real estate records. Appraises and assesses the real and personal property for ad valorem taxation; That means that property taxes are only. Woodward County Ok Tax Assessor.